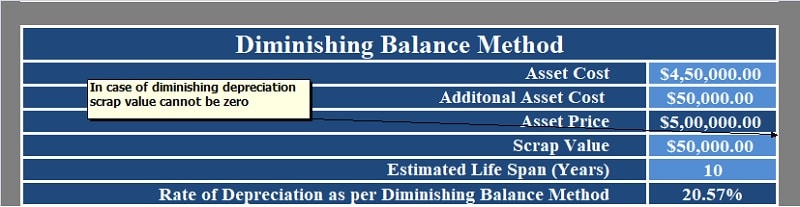

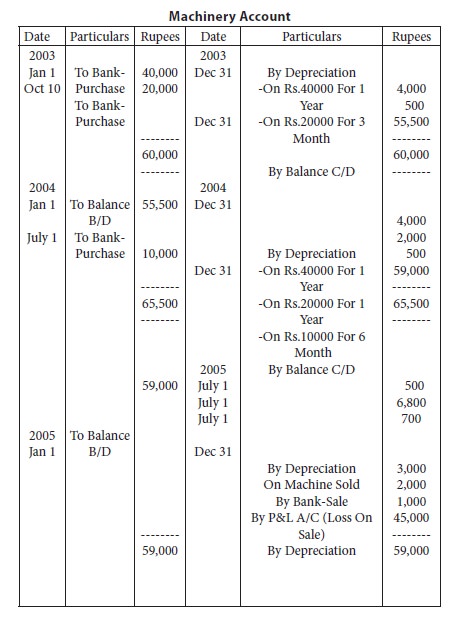

A Machinery was purchased for ई 1,80,000 on 1 st July, 2015. Depreciation was charged annually @ 10 % on Diminishing Balance Method. 1 / 4 th of this Machinery was sold

Diminishing Balance Method/Written Down Value Method A machine is purchased for Rs 51,200 Its life is expected - Accountancy - Analysis of Financial Statements - 16904419 | Meritnation.com

Diminishing Balance Method Depreciation Ppt PowerPoint Presentation Styles Designs Cpb Pdf - PowerPoint Templates

Depreciation - 4 || Diminishing Balance Method || Solved Long Problems || B.Com || BBA || MBA || CA - YouTube

Diminishing Balance Method Depreciation Ppt Powerpoint Presentation Icon Brochure Cpb | Presentation Graphics | Presentation PowerPoint Example | Slide Templates

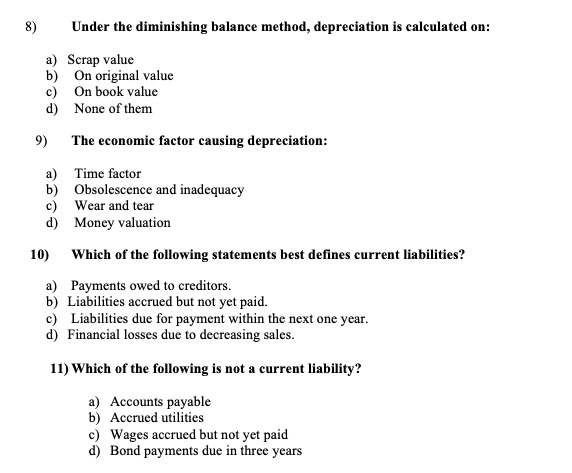

SOLVED: Under the diminishing balance method, depreciation is calculated on: a) Scrap value b) On original value ( On book value d) None of them 9. The economic factor causing depreciation: a)

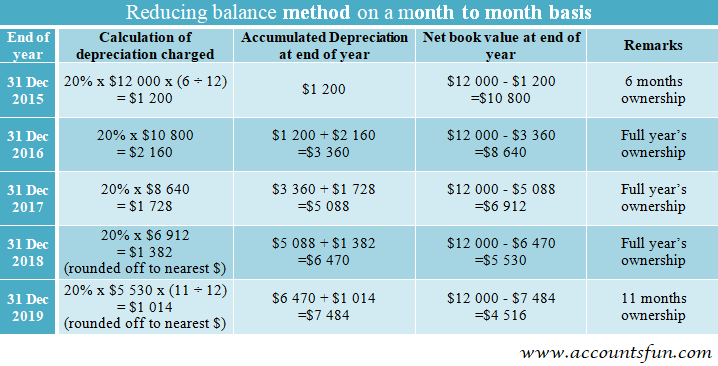

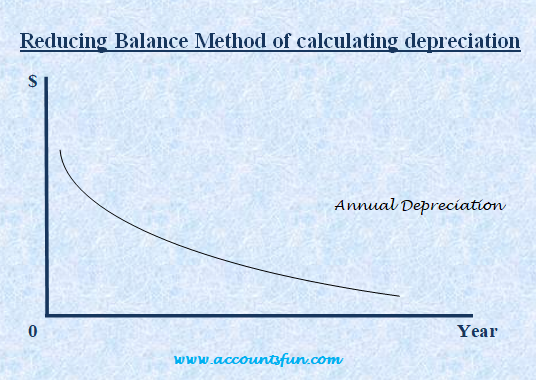

Diminishing balance method of calculating depreciation also known as reducing balance method - Accounting Simpler. Enjoy it!

Methods Of Depreciation - Straight line method, Diminishing balance method and Annuity method are discussed - study Material lecturing Notes assignment reference wiki description explanation brief detail

:max_bytes(150000):strip_icc()/Declining-Balance-Method-Final-68f11785576f4967a35f6ebb555f1fcb.jpg)